The R&D Tax Incentive provides a tax offset for expenditure incurred on eligible R&D activities. This can be either refundable or non-refundable depending on your company’s aggregated turnover or company structure.

Refundable tax offset

For entities with an aggregated turnover of less than $20 million per annum, that are not controlled by tax exempt entities, the company will be eligible for the refundable tax offset. This is provided as an offset of 18.5% above the company tax rate. (For example: A company with $100,000 of R&D expenditure, which is still in losses at the end of the financial year, could get a cheque from the ATO for $43,500 (25% + 18.5%).

Non-refundable tax offset

For entities with an aggregated turnover greater than $20 million per annum, or those that are controlled by tax exempt entities, the company is eligible for the non-refundable tax offset. The benefit is dependent on your ‘R&D intensity’ which is calculated using R&D expenditure over the total company expenditure. The benefit is then broken down into two tiers:

- For R&D intensity up to 2%, an offset of 8.5% above the company tax rate applies. (For example: A company with $100,000 of R&D expenditure which is in profit at the end of the financial year, could get a tax offset of $33,500 (25% + 8.5%) against its tax bill).

- For R&D intensity over 2% receives, an offset of 16.5% above the company tax rate applies. For example: A company with $100,000 of R&D expenditure and total expenditure of $1 million, would get a tax offset of $39,900. This includes $6,7000 (25% + 8.5% for the first 2% ($20,000)) plus $33,200 (25% + 16.5% for the remaining $80,000).

Where a company incurs R&D expenditure in excess of $150 million in any one year, the offset for expenditure over the cap of $150 million is restricted to the company tax rate for that expenditure only.

Eligible Activities

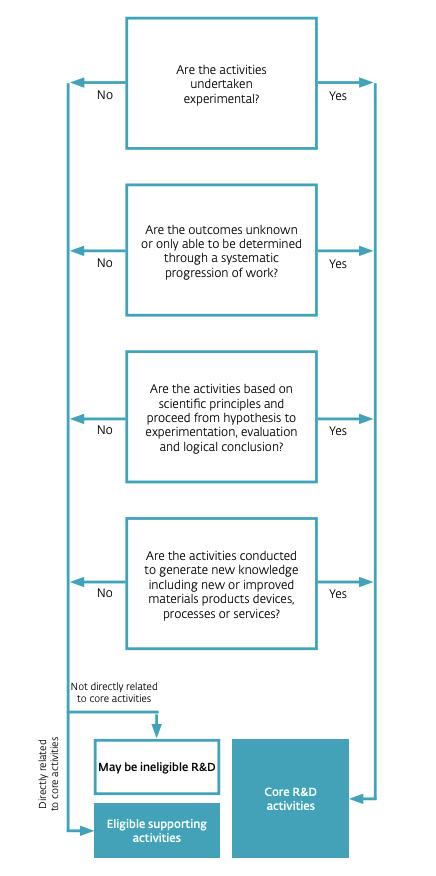

Generally, eligible R&D activities are those undertaken for the purpose of developing new or improved products or processes. R&D activities are experimental in nature and whose outcome cannot be determined in advance.

If you’re developing something new or improved, or solving a technical problem by following an experimental process, your company may be eligible to claim.